capital gains tax rate 2022

Dynamic 10-Year Revenue 2022 to 2031-1329. Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income.

Capital Gains Tax Long Term Short Term Rates Calculation

2022 Capital Gains Tax Rate Thresholds Capital Gains.

. The standard rate of Capital Gains Tax is 33 of the chargeable gain you make. 2022 Long-Term Capital Gains Tax Rates. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

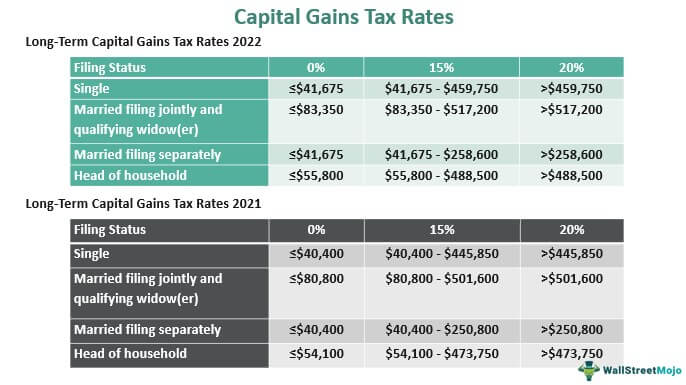

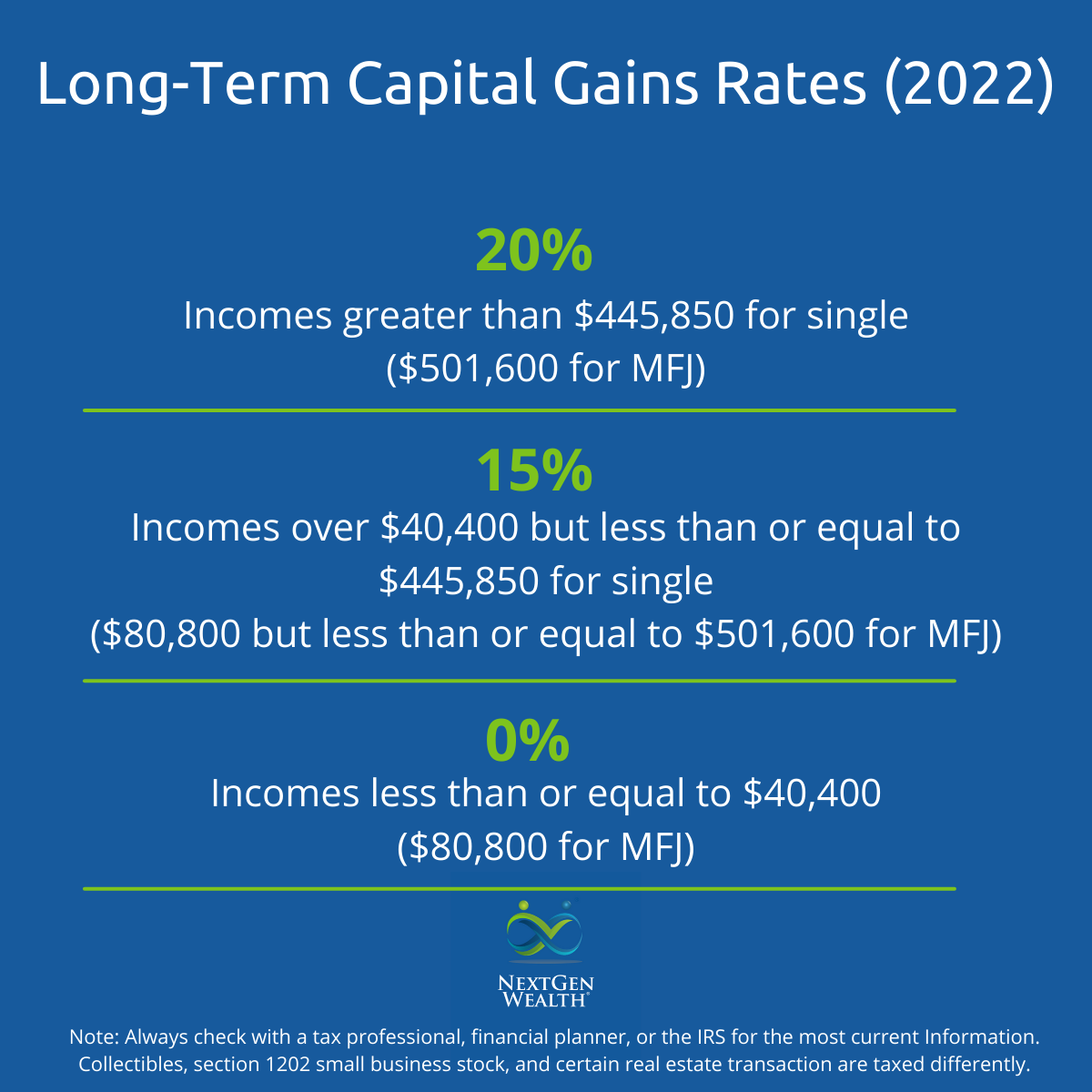

Filing Status 0 rate 15 rate 20 rate. Capital Gains Tax Rates Brackets Long-term. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20.

The refundable portion of the Child Tax Credit is adjusted for inflation and will increase from 1400 to 1500 for 2022. Top combined capital gains tax rates would average 48 under the plan. 500000 of capital gains on real estate if youre married and filing jointly.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Here are the details on capital gains rates for the 2021 and 2022 tax years. Capital Gain Tax Rates.

The tax rate on most net capital gain is no higher than 15 for most individuals. Married couples filing jointly. Some or all net capital gain may be taxed at 0 if your taxable income is.

For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022. First deduct the Capital Gains tax-free allowance from your taxable gain. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance. Short-term gains are taxed as ordinary income based. Tax filing status 0 rate 15 rate 20 rate.

Annual exempt amount limits have been added for 2022. Short-Term Capital Gains Tax Rates for 2022. Depending on your regular income tax bracket your.

See What Are the Capital Gains Tax Rates for 2022 vs. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT. Tax Changes and Key Amounts for the 2022 Tax Year.

Most single people with investments will fall into the. Capital Gains Tax. Long-term capital gains are gains on assets you hold for more than one year.

Tax Foundation General Equilibrium. The IRS has already released the 2022 thresholds see table below so you can start planning for 2022 capital asset sales now. The IRS typically allows you to exclude up to.

For example if you dispose of an asset in the period January to November 2022 you must pay the Capital. Heres how short-term capital gains tax rates for 2022 compare by filing status. For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly.

It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be. Theyre taxed at lower rates than short-term capital gains. Add this to your taxable income.

Long-term capital gains tax rates for the 2021 tax year. 250000 of capital gains on real estate if youre single. Taxable income of up to 41675.

How To Calculate Capital Gains Tax On Real Estate Investment Property

Maximizing Nua Benefits For Employee Stock Ownership Plans

What You Need To Know About Capital Gains Tax

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Short Term Capital Gains Tax Equitymultiple

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

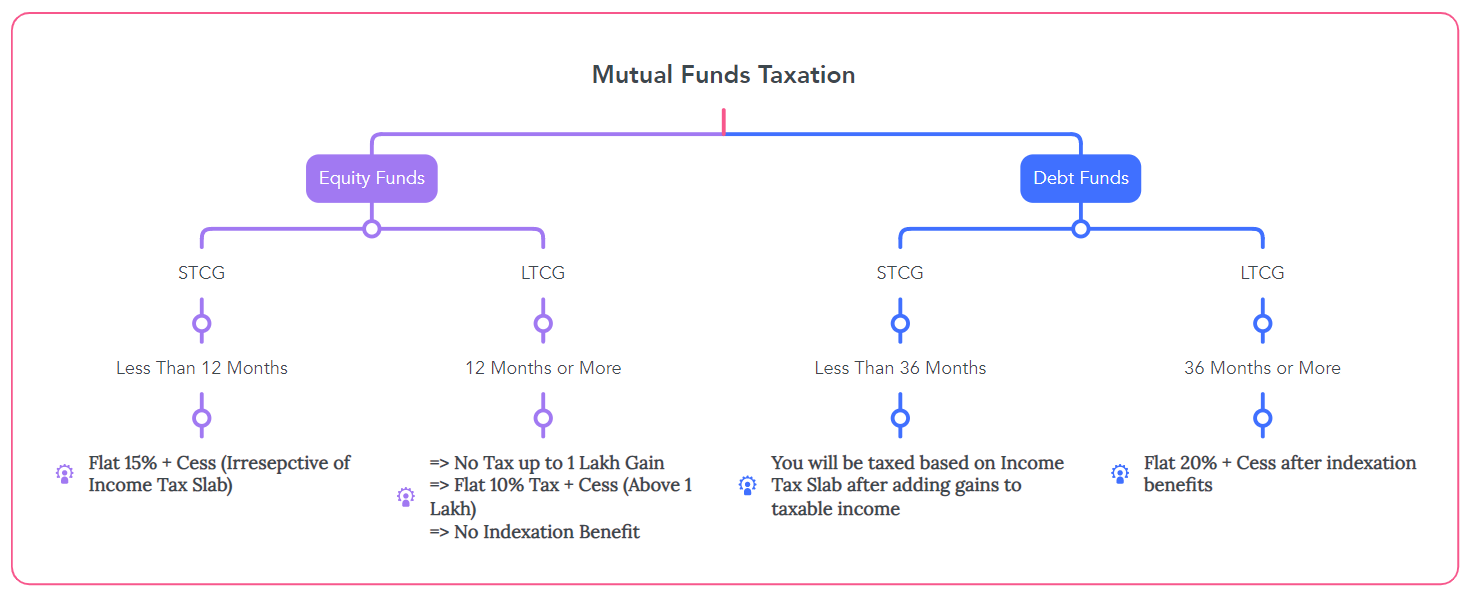

Mutual Fund Taxation A Y 2022 23 Stcg Ltcg And Dividends

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Can Capital Gains Push Me Into A Higher Tax Bracket

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Capital Gains Tax Rates 2022 23 How Much Do You Have To Pay Thp

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

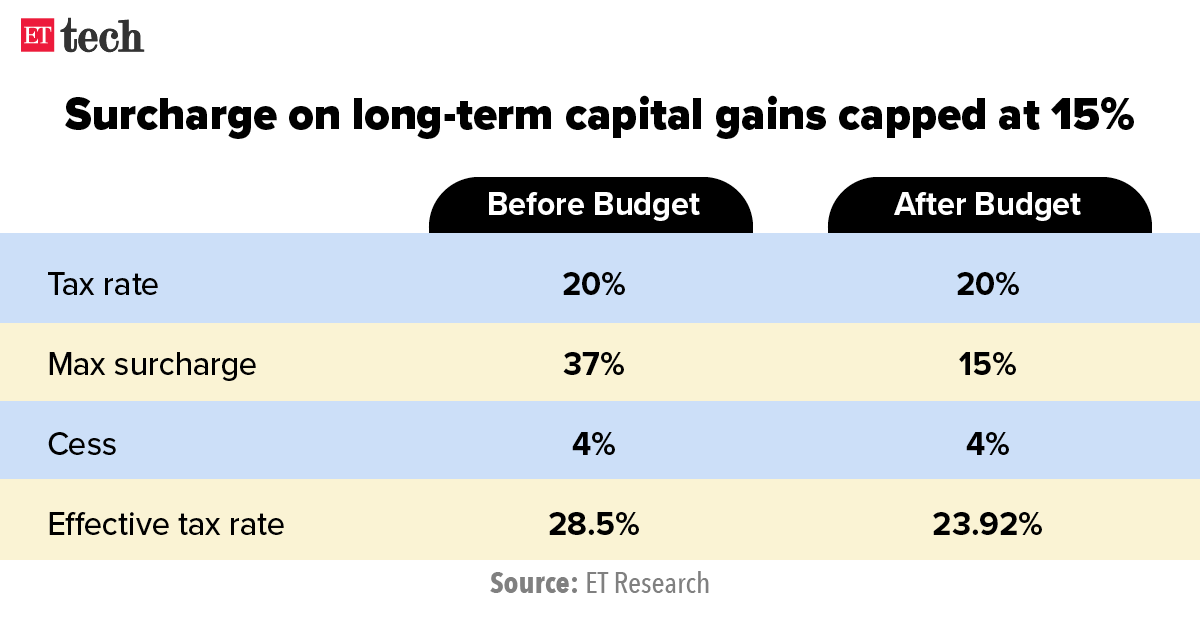

Budget 2022 Budget 2022 Startup Founders Investors To Benefit From 15 Cap On Tax Surcharge The Economic Times